Democratic victories in Georgia position the President to raise capital gains and corporate taxes. During his presidential campaign, President Joe Biden called for raising taxes on corporations, estates, and high-income households. These proposals would entail reversing key parts of the Tax Cuts and Jobs Act of 2017 and renewing efforts to enact policies that the Obama administration attempted to pass through congress.

Following the victories of the Democratic Senate candidates in Georgia, some of President Biden’s ideas now have a greater chance of passing into law.

Steve Wamhoff of the Institute on Taxation and Economic Policy pointed out that President Biden’s plans are less far-reaching than some Democratic alternatives and are broadly popular with the public. “The issue was always, could Democrats get something on the floor? And the answer to that question is now clearly ‘yes,” Mr. Wamhoff said in a statement on January 7th. “Biden did win after campaigning on raising taxes on corporations.”

Although Democrats now control the executive branch and both chambers of Congress, turning those proposals into law will still be a challenging process considering their slim legislative margins, a weak economy, and a pandemic yet to be contained. The results will likely look different from the campaign-trail proposals, and deliberations may result in substantially less than the $3 trillion in tax increases that Mr. Biden is seeking.

With a narrow margin in the House and Vice President Kamala Harris casting tie-breaking votes in the 50-50 divided Senate, Democrats can’t afford to lose a single vote. President Biden has repeatedly reiterated that he wishes to work across the aisle with Republicans, but unlike other policy areas, tax changes need only a simple majority of senators to pass.

The most probable result according to both the Tax Policy Center1 (run by a former Obama administration official) and the conservative leaning American Enterprise Institute2 is between $2.1 and $2.8 trillion in total tax increases over the next decade.

Measured as a share of the economy, if all the changes were enacted with one law, the increase would be about the same size as the one President Reagan signed in 1982, according to the Tax Policy Center and Treasury Department data. A separate analysis by the conservative leaning Tax Foundation3 said President Biden’s plan would be the biggest tax increase since the 1960s.

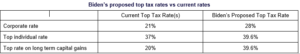

For corporations, he would raise the top tax rate from 21% to 28%, impose a minimum tax of 15% on $100m+ net income companies with lower effective tax rates, and increase taxes on U.S. companies’ foreign earnings. His plan would tax capital gains and dividends at the same rate as ordinary income for taxpayers with incomes above $1 million and tax unrealized capital gains at death. This would effectively double the top capital gains tax rate from 20% to 39.6%.

While it is possible that these provisions could be made retroactively effective to January 1 2021, the Tax Policy Center estimates the effective date would be January 1 2022 at the earliest, citing the uncertainty of the legislative environment caused by the ongoing COVID-19 pandemic and related economic disruptions.

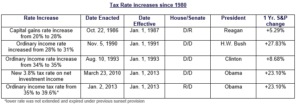

The table below illustrates that there has only been one instance since 1980 in which a tax increase was made retroactively effective. Tax increases typically are not made effective until the fiscal year following their passage through congress and approval from the President.

Additionally, the data shows that the S&P 500 index has made positive gains in years with tax increases, indicating higher axes don’t necessarily result in dampening market capitalization growth.

Conclusion

While the incoming Biden administration campaigned heavily on raising taxes on capital gains and corporations, history indicates that the earliest these changes would likely be enacted is January 2022.

Business owners considering selling their companies within the next few years could be facing capital gains taxes doubling after 2021, substantially reducing the amount they’re able to take home from a sale.

ShareFEB

2021